Ethereum Price Dip: Silver Lining Amidst 20% Sell-Off?

Ethereum’s 20% price drop has shaken the market, but derivatives and options data suggest resilience and a potential recovery to $2,800.

null

Ethereum Price Dip: Silver Lining Amidst 20% Sell-Off?

The cryptocurrency market experienced a significant downturn recently, with Ethereum (ETH) taking a particularly hard hit. A brutal 20% sell-off sent shockwaves through the community, leaving investors wondering if the worst is yet to come. While the immediate impact has been undeniably negative, a deeper analysis of market sentiment, derivatives data, and on-chain metrics reveals a potential silver lining for ETH. This article delves into the factors contributing to the price dip, explores the potential for a rebound, and examines the overall health and future prospects of Ethereum. We will explore the current **ETH price** action and what influences might be at play.

The recent market correction wasn’t isolated to Ethereum. Bitcoin and other major altcoins also experienced significant price declines, signaling a broader risk-off sentiment across the crypto landscape. This sell-off was fueled by a combination of factors, including rising inflation fears, increasing regulatory scrutiny, and profit-taking after a sustained period of growth. For **Ethereum**, the decline was exacerbated by concerns surrounding network congestion and high transaction fees, issues that the ongoing upgrades aim to address. However, despite these challenges, the underlying fundamentals of Ethereum remain strong, supported by its robust developer community, thriving DeFi ecosystem, and increasing adoption by institutional investors.

This article aims to provide a comprehensive **Ethereum price analysis**, examining not only the causes of the recent dip but also the indicators suggesting a potential recovery. We will analyze the derivatives market, including options and futures data, to gauge investor sentiment and identify potential support and resistance levels. Furthermore, we will explore the impact of the Ethereum upgrades on its long-term value proposition. By providing a balanced and data-driven perspective, we hope to equip readers with the knowledge necessary to navigate the current market volatility and make informed investment decisions. In addition, we’ll examine how broader **cryptocurrency market analysis** impacts Ethereum’s price.

Ultimately, the future price of Ethereum is subject to a multitude of factors, many of which are outside of direct control. The broader economic environment, regulatory developments, and technological advancements will all play a crucial role in shaping its trajectory. However, by understanding the underlying dynamics of the market and staying informed about the latest developments, investors can position themselves to capitalize on the opportunities that arise. In conclusion, while the recent **Ethereum** price dip may seem alarming, a closer look reveals a potential for recovery and continued growth, underpinned by its strong fundamentals and innovative ecosystem. Stay tuned to find out whether a recovery of **ETH Price** is possible.

BRUTAL 20% ETHEREUM PRICE SELL-OFF IS NOT OVER, BUT IS THERE A SILVER LINING FOR ETH?

The recent 20% sell-off in **Ethereum** has undoubtedly rattled investors, raising concerns about the sustainability of the current market rally. While the downward pressure remains significant, a closer examination of the market reveals potential indicators suggesting a possible silver lining for ETH. These indicators range from positive developments in the derivatives market to strong on-chain metrics that highlight continued adoption and usage of the Ethereum network. Understanding these nuances is crucial for investors looking to navigate the current market volatility and make informed decisions about their **Ethereum** holdings.

One of the primary drivers of the recent sell-off was a broader correction in the cryptocurrency market, triggered by macroeconomic factors such as rising inflation and interest rate hikes. These factors led to a risk-off sentiment among investors, prompting them to reduce their exposure to speculative assets like cryptocurrencies. In addition, regulatory uncertainty surrounding the cryptocurrency industry further exacerbated the downward pressure. However, it’s important to note that these challenges are not unique to Ethereum and affect the entire **cryptocurrency** market.

Despite the challenges, there are several reasons to believe that the **Ethereum** price may recover in the near future. One key indicator is the activity in the derivatives market, where traders use options and futures contracts to hedge their positions or speculate on price movements. Recent data suggests that there is significant buying activity in ETH call options, which are contracts that give the holder the right to buy **Ethereum** at a specific price in the future. This indicates that some investors believe the price of ETH will rise in the coming weeks and months. The current **market analysis** points toward continued interest in Ethereum.

Analyzing Derivatives Data: A Glimmer of Hope for ETH?

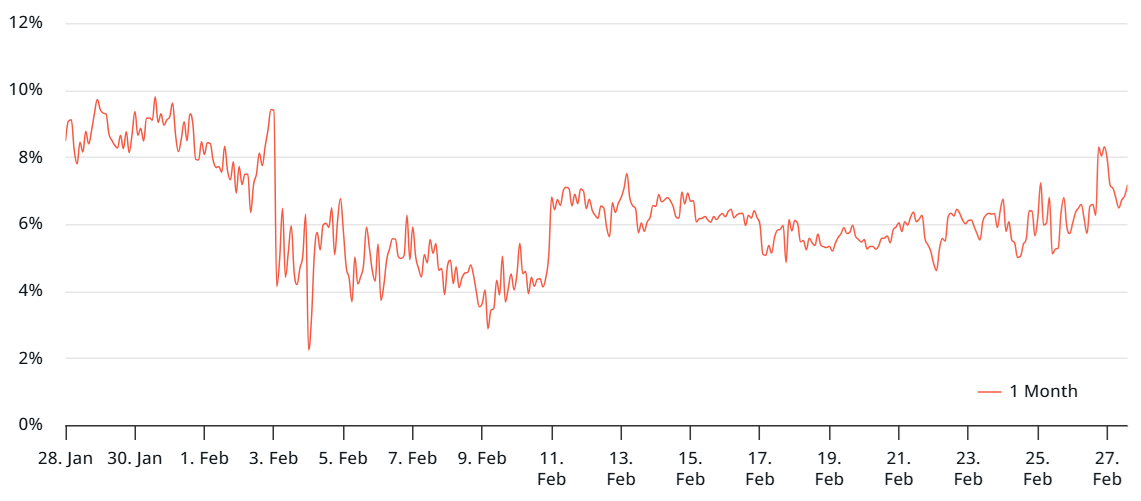

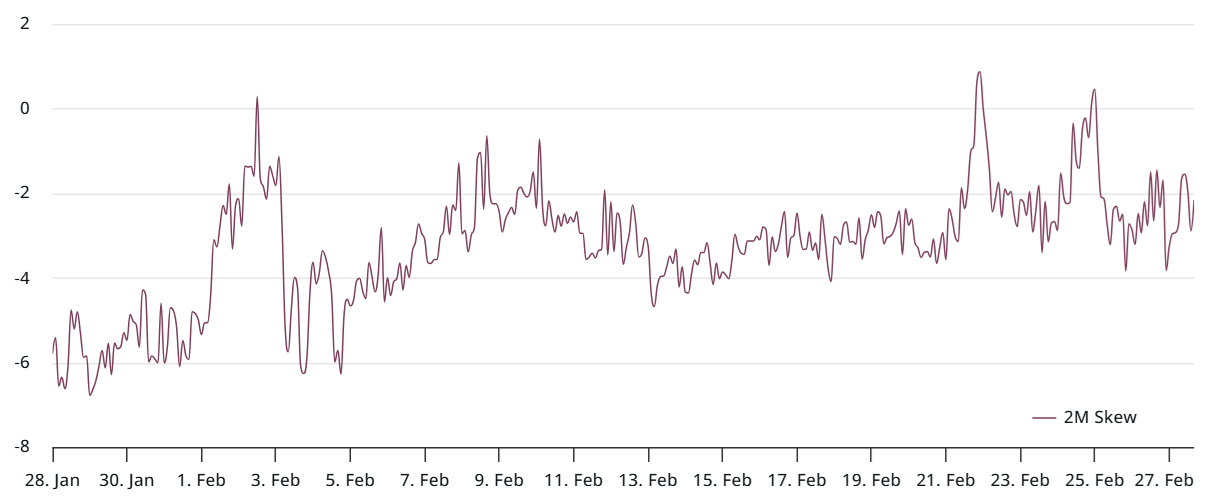

The derivatives market provides valuable insights into investor sentiment and potential future price movements. By analyzing options and futures data, we can gain a better understanding of how traders are positioning themselves in the **Ethereum** market. A key metric to watch is the put/call ratio, which measures the ratio of put options (contracts that give the holder the right to sell ETH) to call options (contracts that give the holder the right to buy ETH). A low put/call ratio suggests that more traders are betting on the price of ETH to rise, while a high ratio indicates bearish sentiment.

Currently, the put/call ratio for **Ethereum** is relatively low, suggesting that there is more bullish sentiment than bearish sentiment in the derivatives market. This is further supported by the increasing open interest in ETH call options, which means that more traders are opening positions to buy **Ethereum** at a specific price in the future. This activity suggests that some investors believe that the recent sell-off is a temporary setback and that the price of ETH will eventually recover. Analyzing the current market is paramount to making informed decision about future prices.

However, it’s important to note that the derivatives market can be volatile and subject to manipulation. Therefore, it’s crucial to consider other factors, such as on-chain metrics and fundamental analysis, when making investment decisions. Furthermore, the impact of regulatory developments on the derivatives market should not be underestimated. Increased regulatory scrutiny could lead to lower trading volumes and increased volatility, which could affect the accuracy of derivatives-based indicators.

On-Chain Metrics: A Sign of Continued Adoption and Usage

Beyond the derivatives market, on-chain metrics provide valuable insights into the underlying health and adoption of the **Ethereum** network. These metrics include the number of active addresses, transaction volume, and total value locked (TVL) in DeFi protocols. A sustained increase in these metrics suggests that the Ethereum network is continuing to grow and attract new users, despite the recent price volatility.

Despite the recent sell-off, the number of active addresses on the **Ethereum** network remains relatively high, indicating that users are still actively using the network for transactions and other activities. Transaction volume has also remained robust, suggesting that there is continued demand for ETH as a medium of exchange. Furthermore, the TVL in DeFi protocols built on Ethereum has remained relatively stable, indicating that users are still confident in the security and functionality of these protocols.

These on-chain metrics suggest that the underlying fundamentals of **Ethereum** remain strong, despite the recent price volatility. This is a positive sign for the long-term prospects of ETH, as it indicates that the network is continuing to attract new users and maintain its position as a leading blockchain platform. The strong fundamentals of the Ethereum blockchain will support the **ETH price** in the long term.

The Impact of Ethereum Upgrades on its Long-Term Value Proposition

The ongoing Ethereum upgrades, including the transition to a proof-of-stake consensus mechanism (also known as “The Merge”) and the implementation of sharding, are expected to significantly improve the network’s scalability, security, and energy efficiency. These upgrades are crucial for addressing some of the key challenges facing Ethereum, such as high transaction fees and network congestion. The successful completion of these upgrades could significantly enhance Ethereum’s long-term value proposition and attract even more users and developers to the platform. If you want to understand more, read What is Ethereum?

The transition to a proof-of-stake consensus mechanism is expected to reduce Ethereum’s energy consumption by over 99%, making it a much more environmentally friendly blockchain platform. This is a significant advantage, as concerns about the environmental impact of cryptocurrencies have been growing in recent years. Furthermore, the implementation of sharding is expected to significantly increase the network’s transaction throughput, making it more scalable and capable of handling a larger volume of transactions. Improved efficiency will increase the utility of **Ethereum**, and therefore the **ETH price**.

These upgrades are expected to have a positive impact on the price of **Ethereum** in the long term, as they will make the network more attractive to users, developers, and investors. However, it’s important to note that the upgrades also come with risks, such as potential technical challenges and security vulnerabilities. Therefore, it’s crucial to stay informed about the progress of the upgrades and to assess the potential risks and benefits before making any investment decisions. The potential upside will benefit the **cryptocurrency** market as a whole.

The cryptocurrency market is known for its volatility, and **Ethereum** is no exception. The recent price dip serves as a reminder of the risks involved in investing in cryptocurrencies. However, volatility also presents opportunities for savvy investors who are prepared to manage risk and capitalize on market fluctuations. Here are some strategies that ETH investors can use to navigate market volatility:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your cryptocurrency portfolio by investing in a variety of different assets. This can help to reduce your overall risk exposure.

- Set Stop-Loss Orders: Stop-loss orders automatically sell your ETH if the price falls below a certain level. This can help to limit your losses in the event of a sharp market decline.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money in ETH at regular intervals, regardless of the price. This can help to smooth out your average purchase price and reduce the impact of market volatility.

- Stay Informed: Keep up-to-date on the latest news and developments in the cryptocurrency market. This will help you to make informed investment decisions and react quickly to changing market conditions.

- Consider Long-Term Investing: Focus on the long-term potential of Ethereum and avoid making rash decisions based on short-term price fluctuations.

Conclusion: Is Now the Time to Buy Ethereum?

The recent **Ethereum** price dip presents a complex picture for investors. While the 20% sell-off was undoubtedly painful, a deeper analysis reveals potential signs of resilience and recovery. Derivatives data suggests a bullish sentiment among some traders, while on-chain metrics indicate continued adoption and usage of the **Ethereum** network. Furthermore, the ongoing Ethereum upgrades promise to enhance the network’s scalability, security, and energy efficiency, potentially boosting its long-term value proposition. This article offers a **cryptocurrency market analysis**, specifically focused on Ethereum.

Whether now is the right time to buy **Ethereum** depends on your individual investment goals, risk tolerance, and investment horizon. If you are a long-term investor who believes in the potential of Ethereum, the recent price dip could present a buying opportunity. However, it’s important to acknowledge that the cryptocurrency market remains volatile and that there are risks involved. Conduct thorough research, understand the potential downsides, and only invest what you can afford to lose.

Remember to stay informed, diversify your portfolio, and manage your risk carefully. The **Ethereum price** is subject to market forces but its strong fundamentals suggest potential for future gains. By following these strategies, you can navigate the market volatility and potentially profit from the long-term growth of **Ethereum**. Don’t forget to read more on Cryptocurrency to stay informed!

Call to Action: Ready to take the next step? Explore reputable cryptocurrency exchanges to buy and sell Ethereum. Remember to do your own research and understand the risks before investing.

“`

Comments are closed.