SEC Drops Lawsuit Against Coinbase

The SEC has voluntarily dismissed its lawsuit against Coinbase, ending the case permanently. The agency is shifting its crypto regulatory approach.

null

SEC Drops Lawsuit Against Coinbase

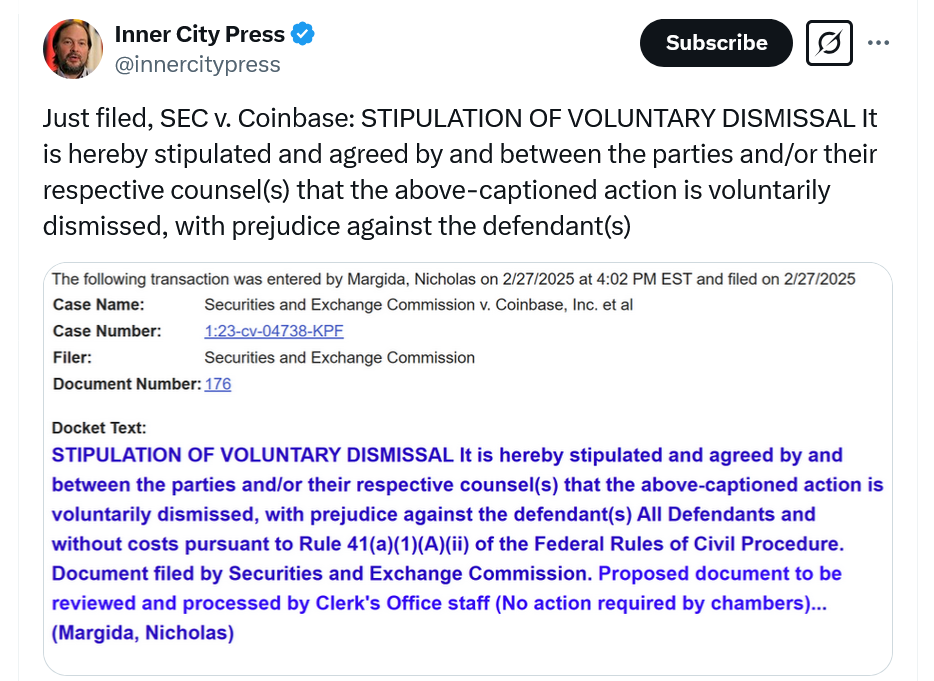

In a surprising turn of events, the Securities and Exchange Commission (SEC) has voluntarily dismissed its lawsuit against Coinbase, one of the leading cryptocurrency exchanges in the United States. This decision marks a significant shift in the regulatory landscape for the crypto industry and raises questions about the SEC’s future approach to crypto regulation. The dismissal brings an end to a legal battle that has been closely watched by investors, industry experts, and policymakers alike. The SEC’s action suggests a possible re-evaluation of its strategies concerning cryptocurrency exchanges and digital assets. The lawsuit, which focused on allegations of unregistered securities offerings, had cast a shadow over Coinbase and the broader crypto market. This development, however, could signal a more collaborative approach between regulators and the burgeoning crypto industry, potentially fostering innovation and growth. The implications are far-reaching, impacting not only Coinbase but also other cryptocurrency exchanges and digital asset projects navigating the complex regulatory environment. This dismissal underscores the evolving nature of crypto regulation and the need for clear, consistent guidelines to ensure market stability and investor protection. The future of crypto regulation remains uncertain, but the SEC’s decision to drop the lawsuit against Coinbase hints at a potential recalibration of its strategy. As the crypto landscape continues to evolve, stakeholders will be closely watching for further developments and regulatory signals.

SEC DISMISSES LAWSUIT AGAINST CRYPTO EXCHANGE COINBASE

The Securities and Exchange Commission (SEC) has made a noteworthy decision to voluntarily dismiss its lawsuit against Coinbase, a leading cryptocurrency exchange. This development has sent ripples throughout the crypto community, sparking discussions about the future of crypto regulation and the relationship between regulatory bodies and digital asset platforms. The lawsuit, which centered on allegations that Coinbase offered unregistered securities, had been a major point of contention between the company and the SEC. The dismissal suggests a potential change in the SEC’s approach or strategy, although the exact reasons for the decision remain unclear. This move could pave the way for more constructive dialogue and collaboration between regulators and the crypto industry, leading to clearer guidelines and a more stable regulatory environment.

The SEC’s decision to drop the lawsuit against Coinbase is a complex issue with multiple factors at play. While the official reasons for the dismissal haven’t been explicitly stated, several possible explanations exist. One possibility is that the SEC re-evaluated its legal strategy and determined that pursuing the case against Coinbase might not be the most effective way to achieve its regulatory goals. Another possibility is that new evidence or legal precedents emerged that weakened the SEC’s position. It’s also conceivable that the dismissal is part of a broader negotiation or settlement with Coinbase, although no such agreement has been publicly announced. Whatever the underlying reasons, the impact of this decision is significant, potentially setting a precedent for how the SEC approaches similar cases involving cryptocurrency exchanges and digital assets.

Implications for Coinbase and the Crypto Market

The dismissal of the SEC lawsuit has several key implications for Coinbase and the broader cryptocurrency market. For Coinbase, the immediate impact is a removal of a significant legal cloud that had been hanging over the company. This could boost investor confidence, leading to a potential increase in the company’s stock price and overall market valuation. It also frees up resources and management attention that were previously dedicated to defending against the lawsuit, allowing Coinbase to focus on its core business operations and strategic growth initiatives. Furthermore, the dismissal could strengthen Coinbase’s position in the crypto market, as it demonstrates the company’s resilience and ability to navigate complex regulatory challenges.

For the broader crypto market, the SEC’s decision could be interpreted as a sign of a more lenient or pragmatic approach to regulation. This could encourage greater institutional investment in digital assets, as it reduces the perceived risk associated with regulatory uncertainty. It may also spur innovation and development within the crypto space, as companies feel more confident in operating within a less hostile regulatory environment. However, it’s important to note that the dismissal of the Coinbase lawsuit doesn’t necessarily mean that the SEC is backing away from its regulatory oversight of the crypto industry. The agency is likely to continue to scrutinize crypto exchanges and digital asset projects, focusing on areas such as investor protection, market manipulation, and anti-money laundering compliance. This event could also influence the price and volume of major Cryptocurrencies, such as Bitcoin, Etheruem, and Tether.

The impact extends beyond just Coinbase and the immediate crypto market. The legal outcome could set precedents for other crypto businesses, especially those that have faced regulatory concerns. The case also highlights the ambiguity in the current legal frameworks surrounding digital assets, which could push lawmakers to create more specific and tailored legislation. The resolution could lead to a more mature and stable crypto environment overall. This outcome might attract more institutional investors to the crypto space, as regulatory clarity often reduces risk. The decision could also encourage other nations to revisit their own crypto regulatory strategies.

The SEC’s Evolving Stance on Crypto Regulation

The SEC’s decision to drop the lawsuit against Coinbase raises important questions about the agency’s evolving stance on crypto regulation. Historically, the SEC has taken a relatively cautious and sometimes adversarial approach to the crypto industry, emphasizing investor protection and the need for regulatory compliance. The lawsuit against Coinbase was seen by many as a prime example of this approach, reflecting the SEC’s concerns about unregistered securities offerings and other potential violations of securities laws. However, the dismissal of the lawsuit suggests that the SEC may be reconsidering its strategy and exploring alternative approaches to regulating the crypto market. This could be driven by a number of factors, including the growing maturity of the crypto industry, the increasing recognition of the potential benefits of digital assets, and the need to strike a balance between investor protection and fostering innovation.

One possible explanation for the SEC’s change in approach is that the agency is recognizing the limitations of its current enforcement-based strategy. Pursuing lawsuits against crypto companies can be costly, time-consuming, and may not always be the most effective way to achieve regulatory goals. Furthermore, aggressive enforcement actions can stifle innovation and drive crypto businesses to operate outside of the United States, potentially undermining the SEC’s ability to protect investors. As a result, the SEC may be shifting towards a more collaborative and proactive approach, focusing on working with crypto companies to develop clear regulatory frameworks and ensure compliance with existing laws. This could involve issuing clearer guidance on the application of securities laws to digital assets, establishing registration processes for crypto exchanges and other intermediaries, and promoting best practices for investor protection.

The SEC’s evolving position is also influenced by global regulatory trends. Other countries have been developing comprehensive crypto frameworks, and the U.S. risks falling behind. These international developments could be prompting the SEC to reassess its strategies to maintain the U.S.’s competitive position in the global financial landscape. Regulatory clarity can foster a more predictable business environment, which is attractive to both domestic and international firms. The SEC is likely aiming to strike a balance between protecting investors and enabling innovation, which requires adapting to the dynamic nature of the crypto sector. This shift could lead to more harmonization with international standards, promoting a unified approach to crypto regulation. This could facilitate cross-border transactions and reduce regulatory arbitrage opportunities. The SEC’s adjustments signal a more nuanced understanding of the crypto market’s potential and complexities.

Comparison Table: SEC’s Previous vs. Potential Future Approach

| Feature | Previous Approach | Potential Future Approach |

|---|---|---|

| Focus | Enforcement and Litigation | Collaboration and Guidance |

| Relationship with Crypto Industry | Adversarial | Cooperative |

| Regulatory Clarity | Limited Guidance | Clearer Frameworks |

| Innovation | Potential Stifling Effect | Promotion of Innovation |

| Global Perspective | Less Harmonized | More Aligned with International Standards |

Future Outlook and Potential Scenarios

Looking ahead, the future of crypto regulation in the United States remains uncertain, but the SEC’s decision to drop the lawsuit against Coinbase provides some clues about potential scenarios. One possibility is that the SEC will continue to pursue a more collaborative and proactive approach, working with crypto companies to develop clear regulatory frameworks and ensure compliance with existing laws. This could lead to the establishment of a more stable and predictable regulatory environment, fostering innovation and attracting greater institutional investment in digital assets. However, it’s also possible that the SEC could revert to a more aggressive enforcement-based strategy, particularly if it perceives a rise in fraudulent or manipulative activity in the crypto market.

Another potential scenario is that Congress will step in and pass legislation to provide greater clarity and certainty to the crypto regulatory landscape. This could involve defining the legal status of different types of digital assets, establishing clear rules for crypto exchanges and other intermediaries, and creating a regulatory framework for stablecoins and other emerging crypto products. Such legislation could help to resolve some of the ambiguities and inconsistencies that currently exist in the crypto regulatory environment, providing a more level playing field for businesses and investors. Regardless of the specific path forward, it’s clear that the future of crypto regulation in the United States will depend on the ongoing dialogue and collaboration between regulators, industry participants, and policymakers. It is also importatnt to have some good crypto wallets in anticipation.

The regulatory landscape could evolve in several ways. One possibility is the creation of specialized regulatory bodies or divisions within existing agencies to focus specifically on digital assets. This would allow for more expertise and tailored regulation. Another outcome could be the development of regulatory sandboxes, where companies can test new crypto products and services under controlled conditions, fostering innovation while minimizing risks. Increased international cooperation could also shape the future, with countries working together to establish common standards and prevent regulatory arbitrage. The adoption of blockchain technology by governmental entities could further legitimize and integrate digital assets into mainstream systems. Ultimately, the direction of crypto regulation will depend on the continuous interplay between technological advancements, market dynamics, and policy decisions.

Conclusion: A Turning Point for Crypto Regulation?

The SEC’s voluntary dismissal of its lawsuit against Coinbase marks a potentially significant turning point in the ongoing debate over crypto regulation. While the exact reasons for the SEC’s decision remain unclear, the move suggests a possible re-evaluation of the agency’s approach to regulating the crypto market. This could pave the way for more constructive dialogue and collaboration between regulators and the crypto industry, leading to clearer guidelines and a more stable regulatory environment. The future of crypto regulation in the United States remains uncertain, but the SEC’s decision to drop the lawsuit against Coinbase hints at a potential recalibration of its strategy. As the crypto landscape continues to evolve, stakeholders will be closely watching for further developments and regulatory signals.

The dismissal of the lawsuit opens new pathways for regulatory adaptation and clarity. It underscores the need for flexible and forward-thinking regulatory frameworks that can accommodate the rapid innovation in the crypto space. Clear and consistent guidelines are essential for fostering market confidence and attracting investment. Collaboration between regulatory bodies and industry participants can lead to the development of effective and balanced regulations. The goal should be to create an environment that protects investors while also allowing for innovation and growth. The SEC’s recent actions indicate a willingness to engage in this process, which is a positive sign for the future of crypto regulation. This could lead to a more sustainable and integrated crypto ecosystem.

Stay informed about the evolving regulatory landscape of the crypto industry. Subscribe to our newsletter for regular updates and expert analysis.

“`

Comments are closed.